In any alternative media space, you are sure to find much talk about US dollar dominance, as well as optimistic forecasts of its imminent decline. This is also true in the radical right, where nationalists pine after an end to US imperial hegemony and the rise of a more multipolar world.

Often though, this hope is little more than wishful thinking, with unlikely challengers to US power much overhyped. This is especially true concerning US dollar hegemony, a topic that is ripe for misunderstanding at the best of times.

It’s important to keep in mind that people have been forecasting the decline of the dollar ever since it attained its status as global reserve currency. As far back as 1960, the economist Robert Triffin was warning of an “imminent threat to the once-mighty US dollar”. Understanding the reason for Triffin’s pessimism, and why it turned out to be misguided, is crucial to understanding today’s global monetary system and the enduring dominance of the dollar.

Triffin’s concerns were more informed than most: his “Triffin dilemma”, as it came to be known, highlighted an inherent problem with a country’s national currency also serving as the reserve currency of choice for the international system. The country supplying the world with the reserve currency has to produce a surplus of money, thereby creating a trade deficit. In other words, the supplier country needs to be continually losing money to fill up the reserves of other countries and make the currency a low-risk option to hold as a reserve. But if the supplier country becomes too indebted to the rest of the world in this scenario, then its currency ceases to be such a low-risk asset, and that’s the dilemma.

After World War II, the US sent lots of dollars abroad through the Marshall Plan, military spending, and the American middle-class importing lots of foreign goods. So how did the domestic US dollar get around Triffin’s dilemma? It didn’t.

Enter the Eurodollar

Triffin’s dilemma was especially a problem for the US dollar because it was backed by gold. After all, what would happen when the world needed more dollars than US gold reserves could back? Much like the kind of collapse that would happen if everyone tried to withdraw their money from banks at the same time, the whole system faced implosion if the US could not keep its foreign dollars backed up with gold.

The standard story is that this problem was resolved in 1971, when Richard Nixon ended the Bretton Woods international system and finally decoupled the US dollar from gold. But by this point, private banks had already long replaced gold exchange and quietly adopted a new form of exchange, extricated from any reserves or real currency. This was a truly global, offshore economic system outside the purview of central banks. This was the Eurodollar system. In this context, “Euro” is used as a synonym for “offshore” rather than referring to actual euros. So, the Eurodollar system is the shadow, offshore money system denominated in US dollars.

No one is really sure of how the Eurodollar system emerged (more on that later), but by the late 1950s there had been a huge growth in US dollar deposits in European banks, mostly in the City of London. With pre-war practices, these deposits would have been remitted to the central bank or deposited to the banks’ accounts in the U.S., but gradually, banks began to use these dollar deposits to issue loans denominated in US dollars. By 1959, the economist Paul Einzig reported that

The Eurodollar market was for years hidden from economists and other readers of the financial press by a remarkable conspiracy of silence. I stumbled on its existence by sheer accident in October 1959, and when I embarked on an enquiry about it in London banking circles several bankers emphatically asked me not to write about the new practice.1

Britain’s economic goal of making London a center for international financial capital manifested in deregulation and comprehensive secrecy protections; this gave the city a competitive edge against other European countries, and put it and its web of British offshore territories at the very centre of this emerging system.

As the Eurodollar market exploded, it became the lifeblood of the global economy, quickly fulfilling a need banks had for an international currency system. Banks could now transact rapidly and efficiently across countries and continents without the need of a physical currency, an innovation that helped unleash economic activity. The Eurodollar system functioned like an early cryptocurrency, existing as a digital ledger and communications network rather than a traditional currency.

Driving the global economy is a kind of bankers virtual currency, created by and used to satisfy the demands of banks, a series of claims and liabilities exchanged between banks to meet their monetary needs. How can you travel to Indonesia and make an instant withdrawal from an ATM, withdrawing from your local bank back home? Only with a vastly complex and efficient communications network connecting the global banking system.

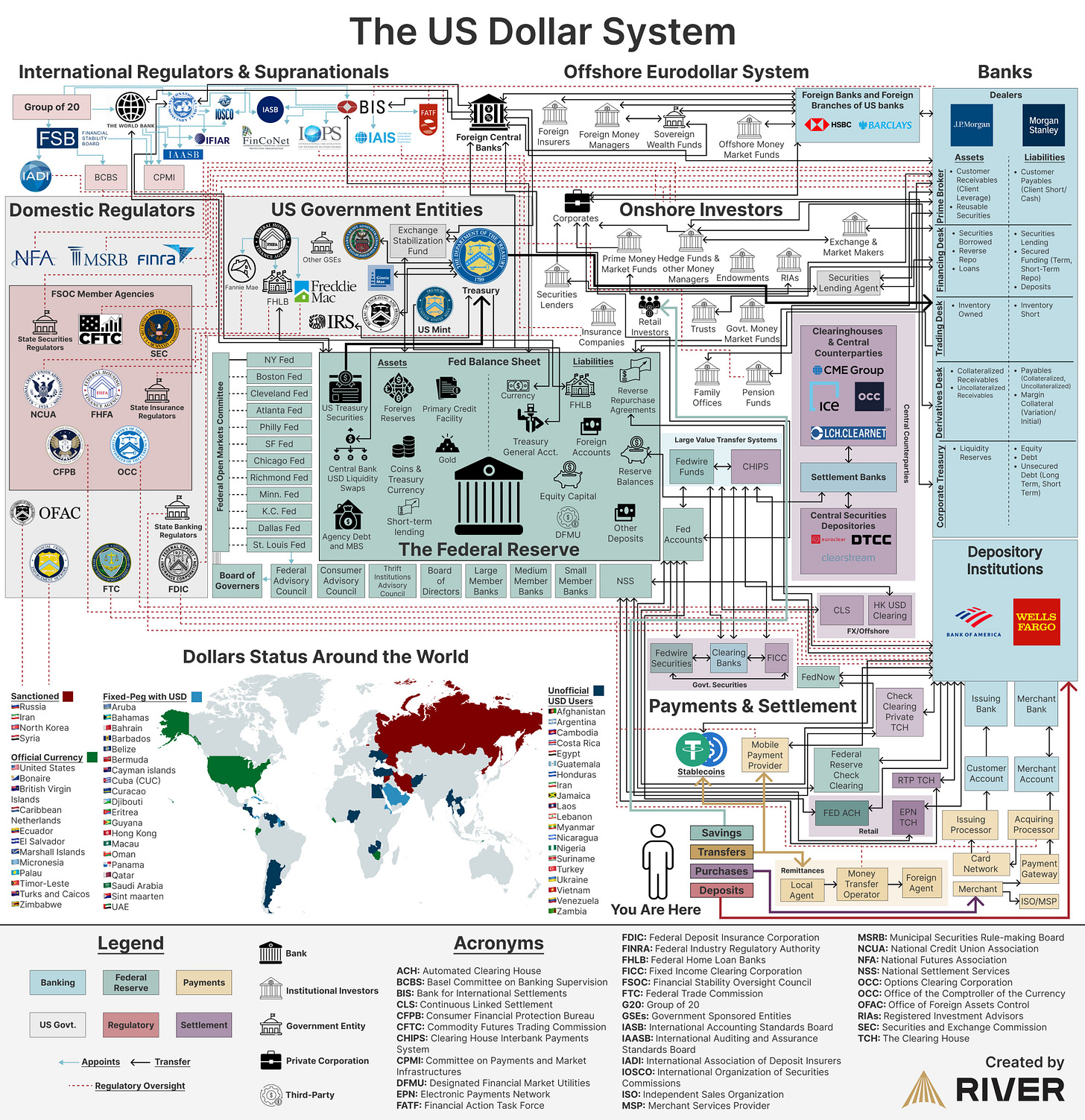

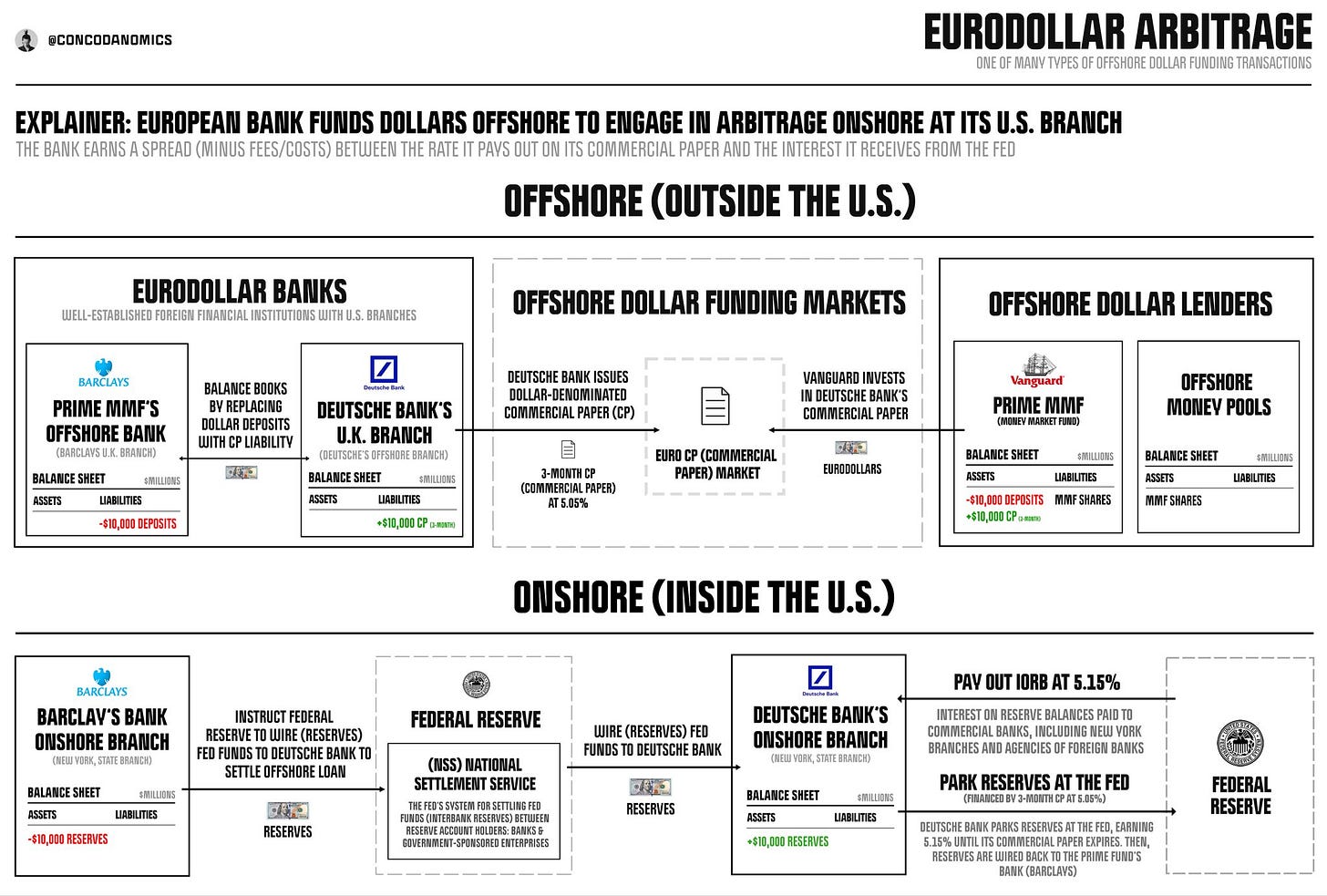

The Eurodollar was the emergence of this system, and central banks have little control over it. For all the scare-mongering from libertarians about “Fed money-printing”, it is international bankers — outside the regulations of the US Federal Reserve — who are the ones in control of creating the US dollar supply on international markets. Big commercial banks create Eurodollars using the offshore system without the backing of the Federal Reserve. This is done through fractional lending, where dollar deposits are used as collateral to loan out a higher amount of dollars.

Again: private banks create money out of thin air by creating debt

Discovering money creation rests with private banks is a revelation that tends to shock people and send them into a state of denial — surely the state would not outsource something this fundamental to private actors.

But don’t take my word for it, a source as good as the Bank of England wrote in a report titled “Money creation in the modern economy” that:

Most of the money in circulation is created, not by the printing presses of the Bank of England, but by the commercial banks themselves: banks create money whenever they lend to someone in the economy or buy an asset from consumers. And, in contrast to descriptions found in some textbooks, the Bank of England does not directly control the quantity of either base, or broad money. Of the two types of broad money, bank deposits make up the vast majority – 97% of the amount currently in circulation. And in the modern economy, those bank deposits are mostly created by commercial banks themselves.2

So international bankers have created a shadow money system, with the Eurodollar system functioning as a kind of “dark energy” of the global economy, ever-present but unseen, something which the US Federal Reserve or any other central bank can do little to control. In fact, no one even knows how much money exists in the Eurodollar system, with estimates measuring it in anything from tens to hundreds of trillions. As the economist Fritz Machlup once told a meeting of his colleagues:

We don’t even know enough about the Eurodollar market to say that it should be controlled.3

If you want to visualise what this shadow money system looks like, this is an attempt at illustrating all the instruments involved in the supply of the US dollar:

Still confused? You’re not alone. If this illustrates anything, it’s that the federal reserve and central banking is just a small part of the story. This enormously complex web developed over decades through private institutions, satisfying the need for a truly global money system unconstrained by national barriers.

But in the process of decoupling the dollar from Federal Reserve reserve control, bankers have given themselves the power to create unsanctioned and unregulated money. This translates to enormous power to override national government’s monetary policy and fulfill many of the roles most people assume central banks and their governments are handling:

Because Eurocurrencies give private financial institutions the unrestricted ability to expand the availability of a particular currency, the country whose currency is the target of the Euroinstrument no longer has exclusive control over its money supply.

…

Furthermore, the lack of reserve requirements on Eurodollars creates a potentially infinite money multiplier, potentially leading to an infinite degree of inflation, all without the input of the Federal Reserve or the U.S. Treasury. Thus, the power to control the number of dollars (or dollar-equivalent instruments) in the market has been taken out of the exclusive control of U.S. authority and diffused among foreign banking institutions.4

Discussion around economics is still heavily focused on central bank monetary policy and government programs like Quantitative Easing, which helps maintain the illusion that it’s still accountable, elected representatives with the final say.

It’s understandable we are biased to focus on government institutions: it has always been understood that monetary sovereignty is a prerequisite for political sovereignty. But it is now clear that governments have quietly surrendered a great degree of monetary sovereignty to the private interests running the international banking system — one of the most significant and revolutionary political changes ever, yet one hardly discussed.

It’s shocking to discover the scope and influence of this system, and to discover everything presented here has been out in the open for years, strangely ignored or overlooked by popular economists, financial analysts and politicians alike. Yet some esteemed economists like Paul Einzig and Milton Friedman did identify and study this system, and both also wrote of a grand “conspiracy of silence” by the global banking cartel to hide its existence. Since most economic analysis still ignores it, we are left with an always partial view of how the economy functions.

Why the dollar isn’t going away

There is another important realisation that comes with understanding the shadow money system: the Eurodollar is the real global reserve currency. The emergence of the Eurodollar system was an emergent innovation, coming from the many players involved in the global financial system seeking the maximally efficient form of money to handle their business. Understanding this helps us understand why it will be so hard to dethrone the dollar from its dominant position.

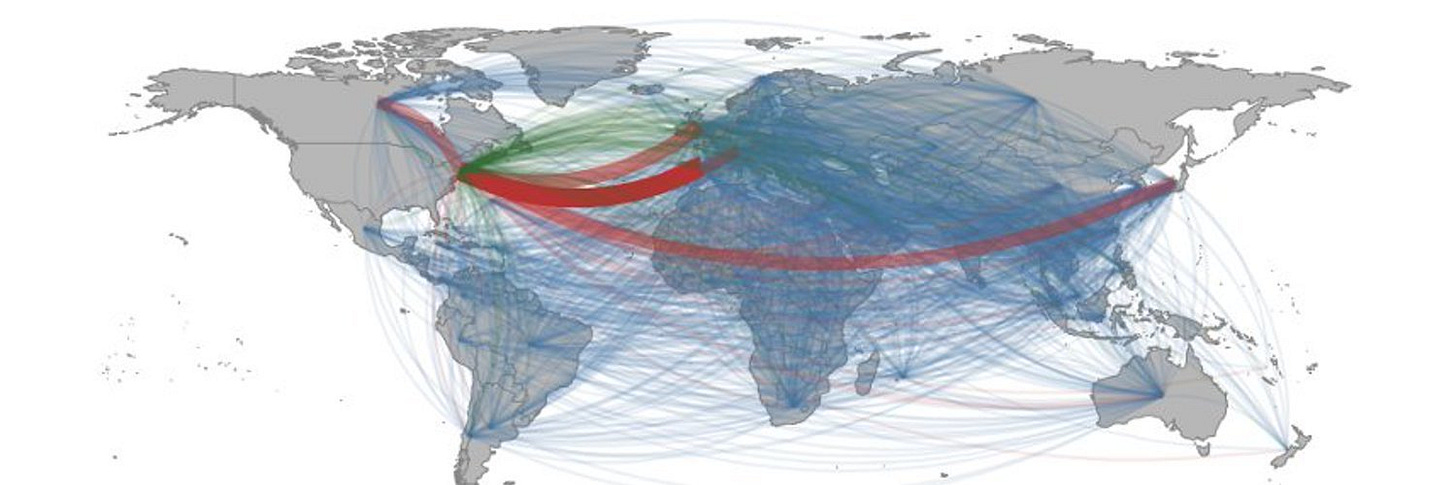

Imagine a world without the dollar. Suppose a German manufacturer needs to import raw materials from Brazil. The Brazilian exporter prefers to be paid in Brazilian reals, while the German importer has funds in euro. Only, there isn’t much from Europe the Brazilian company is interested in spending its new euro on, and constantly exchanging currencies can be costly and time-consuming.

However, with the Eurodollar system, the German importer can use its euro deposits to create a Eurodollar deposit in a German bank. This Eurodollar deposit can then be transferred to a Brazilian bank, which converts it to Brazilian reals and pays the exporter. The Brazilian bank can hold the Eurodollar deposit or use it to fund its own Eurodollar lending activities. Everybody wins! (Or so it must have seemed to the people inventing this system.)

Now imagine a government or governments trying to replace this. There are decades worth of highly complex and interwoven technological arrangements that have made this system function seamlessly. The dollar retains its strength because there is a constant demand for US Treasury securities backing this system.

Looking at how financiers are treating these securities, the dollar looks more secure than ever: US Treasury data reveals the foreign demand for these securities has massively increased in recent years. Holdings of long-term US Treasuries by private foreign investors jumped about 52% over the past three years to $3.4 trillion, for the first time overtaking the holdings of central banks.

Notice that the story here is not about US aircraft carriers or puppet regimes, but the private interests of the bankers that make up this system. A lot of dollar-doomers make a case that is all about geopolitics. The US is an ailing empire they say; it has a large and growing list of enemies, as well as potential challengers on the world stage like China, and we are entering a multipolar age where the US cannot dominate the world’s affairs like it did in the 20th Century. That may all be true, but it doesn’t make the Eurodollar system any less efficient for the global banking cartel.

China has put much effort trying to make its yuan a viable alternative to the dollar, and for all that, less than 3% of the world’s foreign-exchange reserves are denominated in yuan. By one estimate, the dollar is a part of 88% of all international transactions, the euro 31%, while the yuan is involved in just 7% (more than one currency can be involved in a transaction.)

If China wanted to make the yuan a true global reserve currency, they would need to embrace massive financial deregulation and abolish their currently strict capital controls, in order to allow massive inflows of foreign held currency and yuan into China. But China needs to maintain its strict financial regulation for domestic economic success, and political stability. China is unlikely to ever decide to abandon the statist model it has followed for decades just to make itself a better hub for the international financial system.

Some have touted BRICS, of which China is a member, as potentially leading the way in establishing an alternative monetary system. On paper, this looks more promising: BRICS countries have 42% of the world’s population, and an estimated 37% of the world’s GDP.

Could BRICS go about establishing a currency? Presumably, it would need a central bank, and presumably that would be centered in China, representing an unacceptable loss of sovereignty to other countries in the alliance, especially India, with whom it has ongoing territorial conflicts. The idea of a “BRICS coin” has been floated a lot over the years, either backed by gold or fully digital. But just last year, the head of BRICS’ New Development Bank made it clear there are no immediate plans for the group to create a common currency.

Even if BRICS were willing to put aside their disagreements and commit to a BRICS coin, it’s hard to see what competitive advantage it would have over the current system. A gold-backed currency? Bankers abandoned gold and embraced the Eurodollar system in the first place because gold-backed currency was a hindrance to their activities.

What about the “R” in BRICS? Perhaps Russia’s fortunes point to a potential alternative to dollar dominance. After all, since Russia’s invasion of Ukraine, the US government has weaponised the financial system in ways previously unseen. Is this not a display to the world of the precarity of relying on the good graces of America to sustain your financial system? Many reasoned that if the United States overplayed its hand sanctioning Russia, this is the lesson the rest of the world would take, and then it would only be a matter of time before enough interested parties conspired to take down the mighty dollar.

The most headline grabbing sanction against Russia came when the US and its Western allies invoked what some analysts called “the nuclear option”, and colluded to take Russia off of SWIFT (Society for Worldwide Interbank Financial Telecommunication). This was highly significant, as SWIFT is used by banks worldwide as a kind of instant messaging service. President Biden promised that this would “ensure that these banks are disconnected from the international financial system and harm their ability to operate globally.”

With the basic understanding of the US dollar as something strictly under the control of the US government, many assumed they could just deny Russia access to the dollar by cutting them off from the SWIFT system. But despite the high-profile deplatforming, Russian banks suffered little more than an inconvenience from being denied access to SWIFT, because of how effective the Eurodollar system is.

Eurodollar economist Jeffrey Snider summarised the problem with this attempt at deplatforming the Russian economy:

SWIFT constitutes very little insofar as the inner workings of the offshore banking network is concerned.

…

Deprive some of Russia’s institutions their ability to message to correspondents using SWIFT and they’ll simply communicate (how’s that for more irony!) with them some other way (including just picking up the phone) because the offshore correspondents are still there. They will continue to conduct their monetary business regardless of the method payments requests are sent and received.

Ironically, the very fact the US government could do so little to hinder Russian banks’ access to the Eurodollar market shows why it is so effective, and why the dollar will keep its position for the foreseeable future.

This takes us back to the start of this story, when the Eurodollar market emerged under shady and secretive circumstances in the city of London. I wrote no one is really sure how the Eurodollar emerged, but the most likely theory is that the real origin actually lies with the Soviet Union.

In 1956, the Soviets were also in the position of fearing international sanction for invading a smaller neighbour. After they crushed the 1956 rebellion in Hungary, Soviet officials feared the US would target their holdings of dollar deposits in American banks.

In response, the Soviets withdrew their dollars and moved them to two Russian banks based in Europe: Commercial pour L’Europe du Nord (BCEN) in Paris, and the Moscow Narodny Bank in London. Using those dollar deposits, these Russian banks may have become the first lenders in the global Eurodollar market.

On February 28, 1957, the Moscow Narodny Bank in London lent out $800,000. This modest sum was borrowed and repaid entirely outside the American banking system — or any centralised banking system. Bankers had just discovered an amazing innovation. BCEN in Paris also took some Narodny dollars and lent them out. The Paris bank was known by its telex name EUROBANK, and that, supposedly, is how dollars deposited in banks outside the US came to be known as “Eurodollars”.

And so, in one of the great ironies of history, the 20th Century’s great communist regime sparked an innovation on the financial markets that greatly expanded the power of capital and moved the activities of bankers beyond the scope of governments.

The Eurodollar system became so dominant because of innovations from people trying to avoid US government control of their dollars, and that’s precisely why the system is so resilient — to alternate currencies, to geopolitical shocks, and to the US government itself.

Nothing lasts forever, but for now, global dollar dominance is on pretty solid ground.

Einzig, Paul. "Foreign dollar loans in Europe." (1965).

McLeay, Michael, Amar Radia, and Ryland Thomas. "Money creation in the modern economy." Bank of England quarterly bulletin (2014): Q1.

Trestrail, Richard W. 1972. “The Eurodollar Obsoletes the Definition of Money.” Financial Analysts Journal 28 (3): 55–63. doi:10.2469/faj.v28.n3.55.

Fowler, Stephen A. "The monetary fifth column: the eurodollar threat to financial stability and economic sovereignty." Vand. J. Transnat'l L. 47 (2014): 825.

I think the Eurodollar system is not as resilient as you seem to believe. This is a good article about it, from an obscure blogger, but one that presents a very convincing case:

https://fofoa.blogspot.com/2023/01/happy-new-year.html

Some quotes...

"First of all, shadow banking is simply nonbanks (1. the REPO market, 2. money market funds) and non-US-banks (3. Eurodollars) that carry dollar-denominated "deposits" for customers (which are generally big companies; the little guy deposits his money in real banks, big players deposit big money in shadow banks). REPOs, Eurodollars and money market funds are all part of the shadow banking system."

...

"The financial crisis in 2008 was a bank run on the shadow banking system (a run from non-dollar "dollars" into real dollars). Lehman Brothers was a shadow bank that failed before the Fed and the USG backstopped the whole shadow banking system.

There was another financial crisis in March of 2020 that was also a bank run on the shadow banking system. There was a massive bailout, and no "banks" failed. There was also a pandemic underway, so most people didn't notice the financial crisis, even though the bailout was nominally larger than 2008. In both cases, the nonbank non-dollar "dollars" of the shadow banking system were backstopped with real dollars, but nothing was fixed. "

...

"One of the points Lev makes is that no one knows how big it actually is. Not even the Fed knows how many non-dollar "dollars" are out there. He says that's part of the reason they stopped reporting M3, because in reality, they have no idea how much "broad money" exists. In reality, the shadow banking system is likely too big to bail, not too big to fail."

...

"Lev thinks that another "quiet" bank run on the shadow banking system, especially outside of the US (i.e., Eurodollars), could be in the works. Remember, it's a bank run from non-dollar "dollars" into real dollars, which is why the dollar spikes during a run."

...

"Now, as you know, when you deposit your money, even at a real bank, you are essentially loaning your money to the bank. The bank doesn't put your money in a safe, it uses it for other purposes. The same goes for a company depositing $50 million into the REPO market through a nonbank broker-dealer. It is essentially loaning that $50 million to the broker-dealer. But it's not structured as a loan. It's structured as a purchase of a security with an agreement that the security will be repurchased by the broker-dealer the next day (what are called overnight, or O/N REPOs). The security you purchased for a night yields some rate of interest, but you don't get the interest directly from the security. Instead, your share of the interest is worked into the repurchase price of the security. You buy it today at $X, and we'll buy it back from you tomorrow at $X+Y, with Y being your interest rate on the deposit.

Because it's an overnight process, it has to be rolled over each day, and most of the time it is. If you want to withdraw some or all of your money, you simply don't roll it over that day. But remember, just like the bank doesn't keep your dollars in the safe, the REPO broker-dealer doesn't keep your $50 million in cash either. So, if you don't roll it over, the broker-dealer has to sell securities to raise the cash, and not all securities are created equal. Some are harder to sell than others, and if you can't sell enough to raise the cash during a bank run, you go broke. That's what happened to Lehman Brothers."

...

"And here's where the "quiet" bank run on the shadow banking system, especially outside the US, might have already begun. No one knows how big the non-US shadow banking system, aka the Eurodollar system, is. And as the value of the securities it holds to back its non-dollar "dollars" gets pushed down, the credibility of its "stablecoin-like peg" to the dollar gets drawn into question. As foreign entities holding large balances of Eurodollars try to move those funds into real dollars, or even just into something else or some other currency, the Eurodollar system is forced to sell securities and buy dollars on the open market, because it doesn't have access to the Fed's discount window or RRPs.

This puts further downward pressure on security prices, upward pressure on interest rates, and keeps driving the dollar higher and higher, making it more and more costly to obtain. And if the Eurodollar's peg was already in question, this makes it worse, in a vicious circle that may be difficult to stop, due to the unknown size of the Eurodollar system, if it really gets going."